Oregon Tax Lot Map – Oregon state tax can’t get any better when it comes to purchasing goods and services. That’s because Oregon is one of the five states with no sales tax. However, income tax rates are higher in the . it’s a lot less than the $8.6 billion in personal income taxes Oregon expects to collect this year. Oregon taxes estates worth more than $1 million, a low threshold compared to other jurisdictions. .

Oregon Tax Lot Map

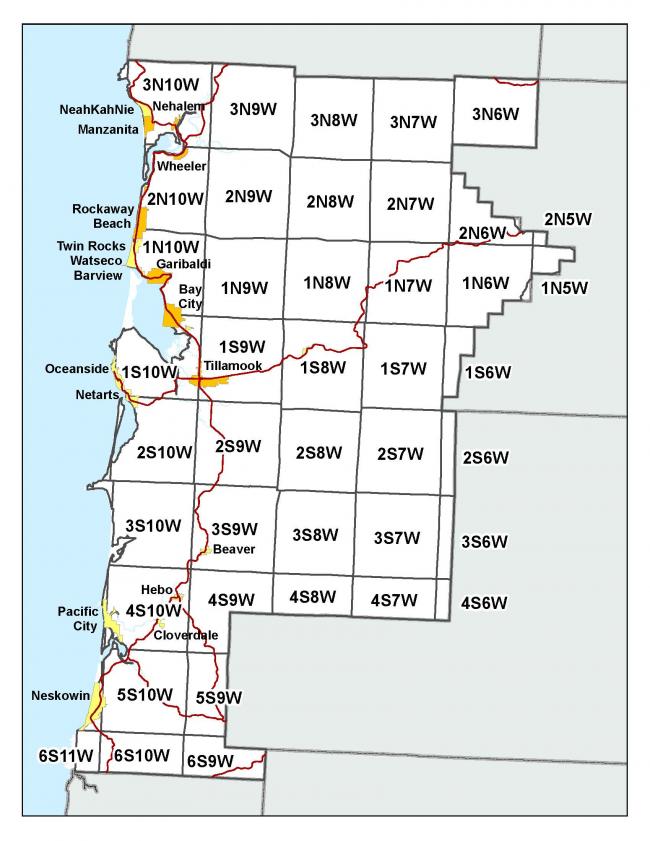

Source : www.tillamookcounty.gov

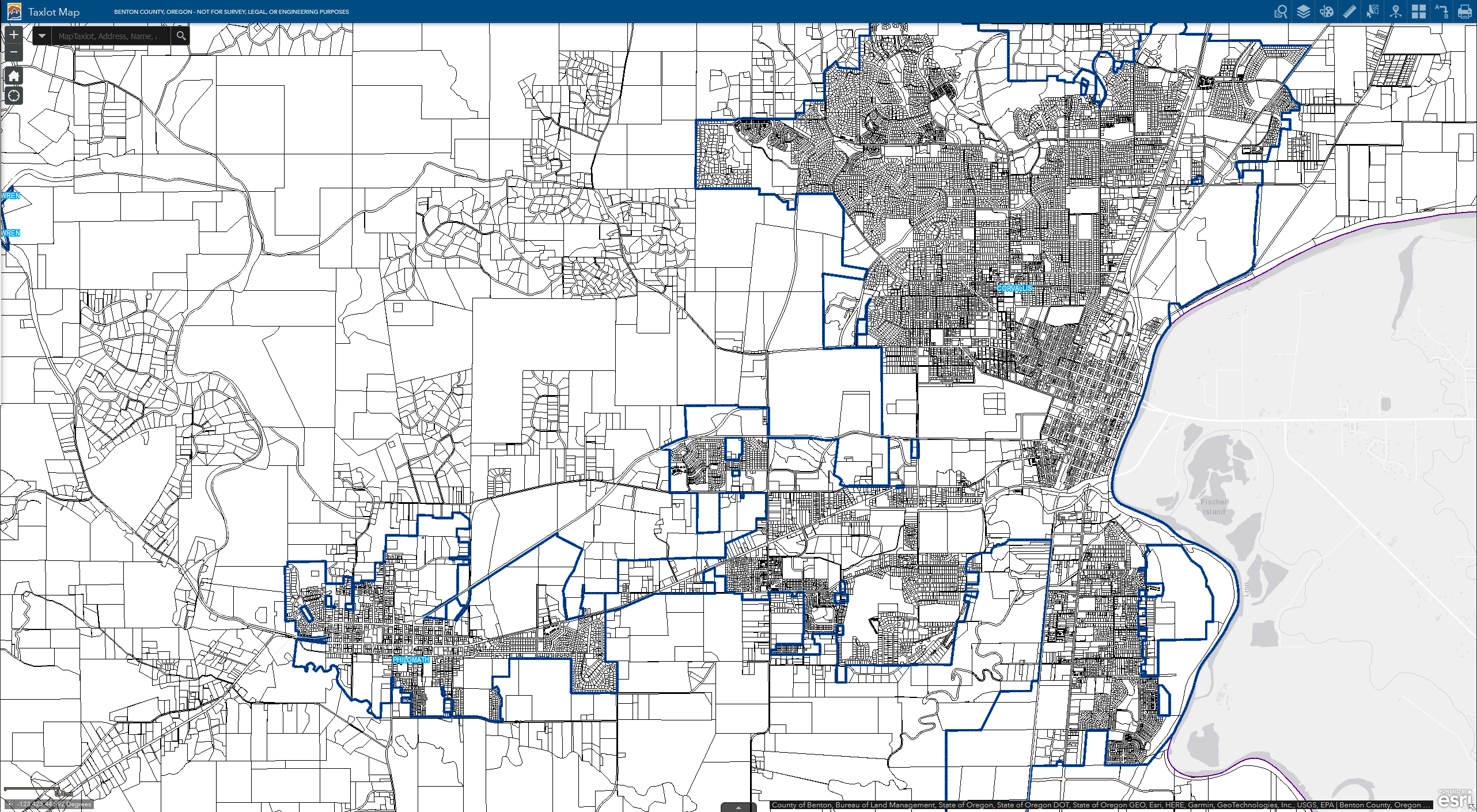

Home Benton County GIS, Oregon

Source : maps.bentoncountyor.gov

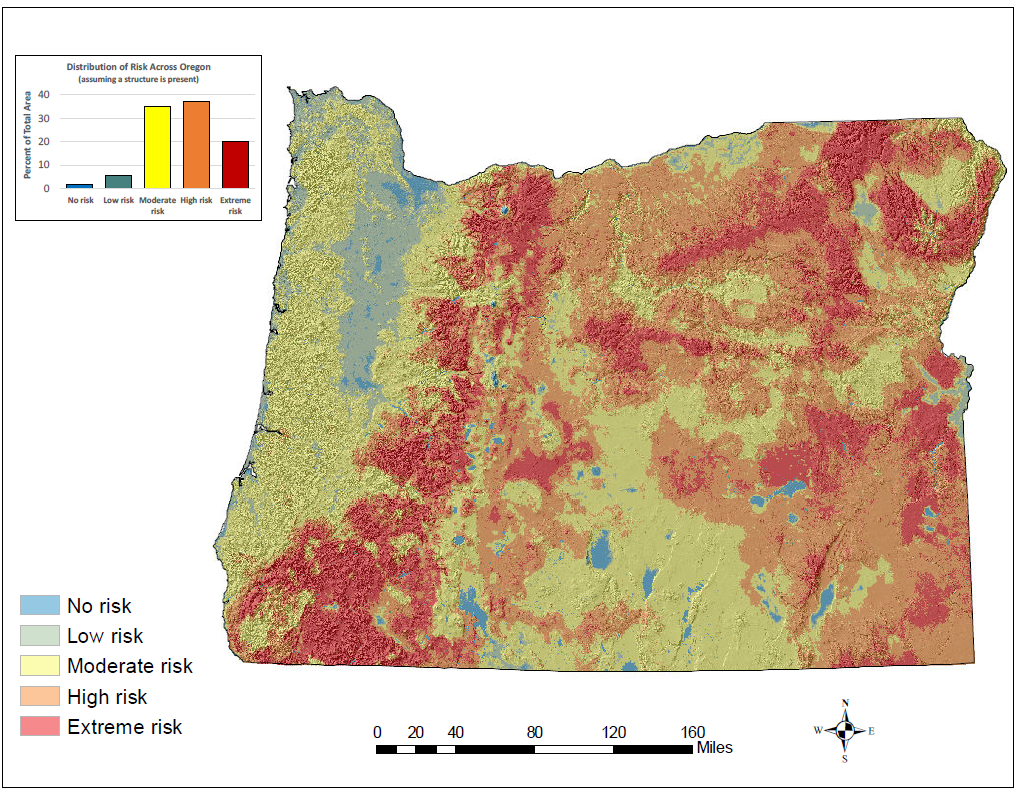

New wildfire maps display risk levels for Oregonians | Jefferson

Source : www.ijpr.org

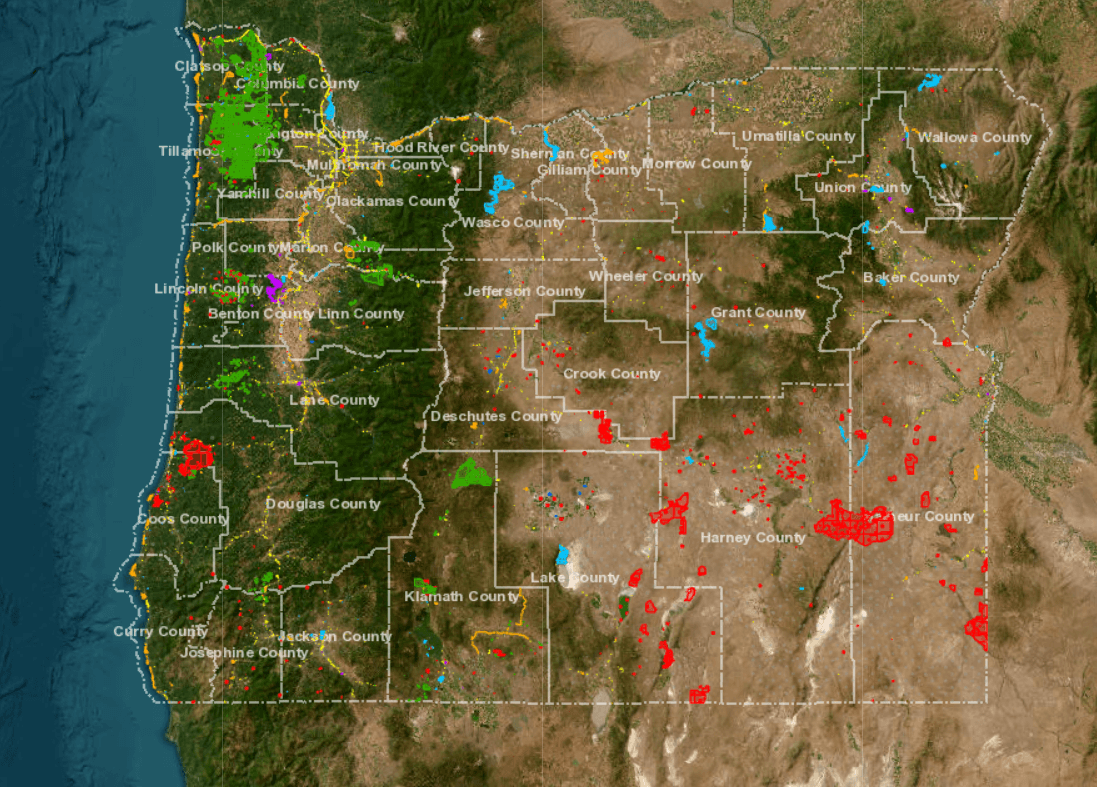

Oregon Department of State Lands : State Lands Maps and

Source : www.oregon.gov

Are you a tax winner or loser? Look up your Portland area home

Source : www.oregonlive.com

What is your Oregon home’s risk of wildfire? New statewide map can

Source : www.opb.org

Hermiston Tax Lot Map

Source : www.arcgis.com

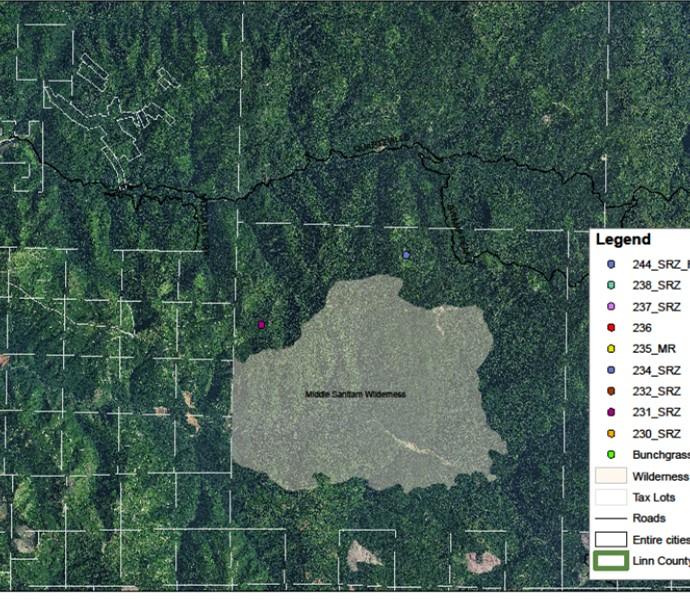

Geographic Information System (GIS) | Linn County Oregon

Source : www.linncountyor.gov

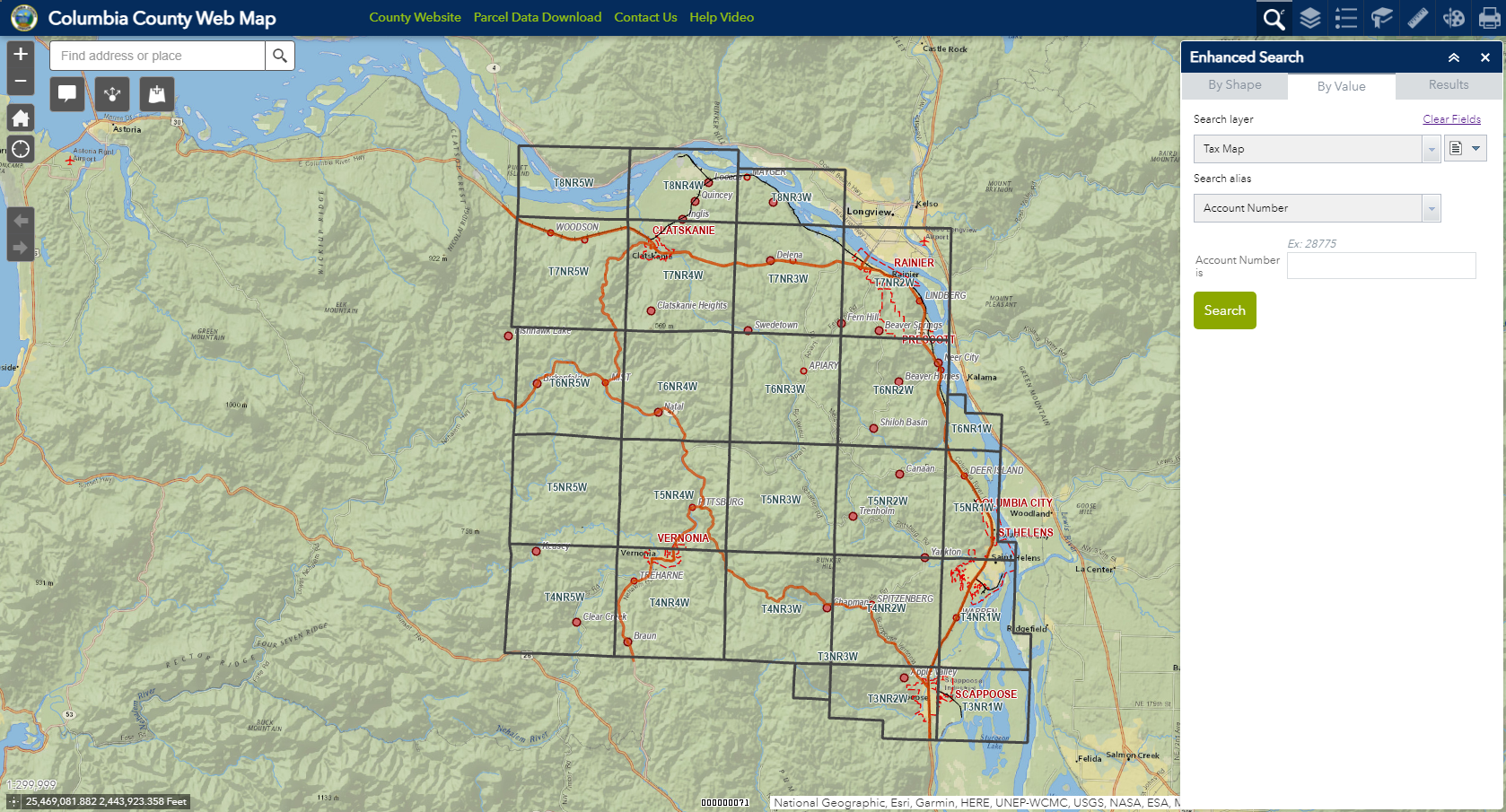

Columbia County, Oregon Official Website GIS & Mapping

Source : www.columbiacountyor.gov

Public invited to weigh in on the latest Oregon Wildfire Hazard

Source : kobi5.com

Oregon Tax Lot Map Tax Maps | Tillamook County OR: If you make $70,000 a year living in Oregon you will be taxed $13,290. Your average tax rate is 10.94% and your marginal tax rate is 22%. This marginal tax rate means that your immediate . Please email us at editor@ballotpedia.org to suggest an improvement. The Oregon tax revolt is a political movement in Oregon which advocates for lower taxes. This movement is part of a larger anti-tax .